Click a button to download a PDF version of Chapter 9

or scroll down to read online.

Carbon credits in the voluntary carbon market (VCM) are used to meet climate goals or to offset emissions related to a particular service or product. Carbon credits may also be purchased and retired without offsetting, which drives removals and reductions in overall greenhouse gas (GHG) emissions and may enable buyers to claim other social and environmental contributions.

What is an offset and how are carbon credits used as offsets?

Most carbon credits are used to offset GHG emissions that are emitted by business, governing, livelihoods, and leisure activities. “Offsetting” counteracts the harm of GHG emissions by reducing or removing GHG emissions of equal proportion. In the case of GHG offsetting, carbon credits, which represent verified emission reductions or removals, are used by emitters to compensate for GHG emissions. Carbon credits are often referred to as “offsets,” although not all carbon credits are used to offset GHG emissions (as discussed below).

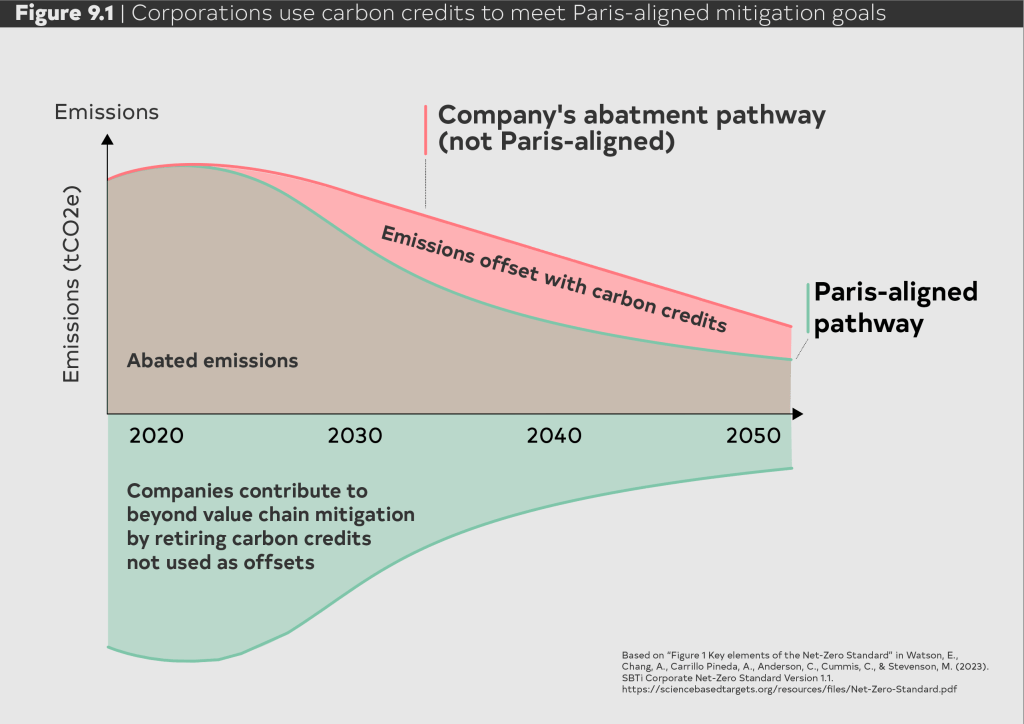

Carbon offsetting can be part of regulated emissions trading systems. For example, under the Colombian Carbon Tax, VCM carbon credits can be used by liable entities to offset carbon tax obligations. However, most of the carbon credits generated in the VCM are used by companies to voluntarily offset emissions to meet corporate climate pledges or to offer ‘carbon neutral’ goods and services. As shown in Figure 9.1, corporations use carbon credits to meet net-zero and carbon neutral goals. Corporations use carbon credits as offsets to compensate for emissions that are difficult to abate under net-zero strategies or neutralize residual emissions. Corporations may also purchase and retire credits without offsetting to contribute to beyond value chain mitigation (BVCM) goals. Initiatives such as the Science-Based Targets initiative (SBTi) are pushing companies to set net-zero goals that are aligned with the Paris Agreement targets, and to limit offsetting with carbon credits for only the most difficult to abate emissions.

What are corporate climate targets?

More and more companies are setting voluntary climate targets. Corporate climate targets are commitments to reduce some or all of a company’s emissions by a certain date in the future. As of July 2023, 9,759 companies had joined the United Nation’s Race to Zero campaign. More than 5,500 companies have set science-based emission reduction targets and net-zero commitments following the guidelines of the SBTi. Companies buy carbon credits on the VCM to offset GHGs that have been emitted above their reduction target or to be able to claim carbon neutrality.

Offsetting is often employed to compensate for those emissions that the company is not (yet) able to reduce internally. When a company has purchased enough carbon credits to offset all emissions generated over a given timeframe, it can claim to be carbon neutral for that period.

What are ‘carbon neutral’ goods and services?

Corporations use ‘carbon neutral’ statements to market their products and services. To market a product or service as carbon neutral, companies should comply with the requirements of a carbon neutrality standard such as the CarbonNeutral Protocol or PubliclyAvailable Specification (PAS) 2060.

This typically involves reducing emissions as much as possible, and then buying enough carbon credits to offset the remaining emissions associated with delivering a good or service. Alternatively, companies can offer consumers the option to individually offset the emissions associated with the good or service they wish to purchase by paying a higher price. For example, airlines offer the option to buy carbon credits to offset GHG emissions from flying.

How do countries use VCM credits and offsets?

Some countries allow the use of carbon credits for compliance purposes under domestic climate regulation. Domestic carbon pricing instruments like carbon taxes and emissions trading systems create demand by allowing liable entities to use carbon credits from approved standards and sectors to meet their obligations. International compliance schemes such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) also create demand. CORSIA enables the use of carbon credits by airlines to help to meet climate goals. In these cases, specific types of carbon credits generated in VCMs can be used for compliance purposes. As such, the boundaries between voluntary and compliance carbon markets blur.

In Colombia, Mexico, and South Africa, liable entities can use carbon credits issued by certain VCM standards to fulfil obligations under those countries’ carbon taxes. Emissions trading systems in China, South Korea, and Mexico allow for the limited use of VCM carbon credits, although emissions trading systems in other jurisdictions (e.g., California, Switzerland, and the European Union) exclude or restrict the use of VCM carbon credits.

What are the advantages and limitations of carbon offsetting?

Offsetting offers a compelling opportunity to compensate for environmental harm done at a price that is lower than the cost of eliminating or abating the original source of harm. Where companies can invest in alternatives rather than directly reducing or removing GHG emissions in their operations or activities, they can save money and still achieve environmental targets. In the case of the VCM, carbon offsetting has the additional advantage that verified carbon credits can channel finance to communities and sectors where finance is needed, giving buyers a compelling social responsibility narrative to promote. Carbon offsetting through the VCM can contribute to the achievement of host countries’ Nationally Determined Contributions (NDCs) and Sustainable Development Goals (SDGs), a benefit that is recognized by some carbon standards. Governments can engage strategically with the VCM by encouraging the development of activities that align with national priorities, channel finance where it is needed, and contribute to the achievement of SDGs.

Despite these benefits, there are important drawbacks to using carbon credits as offsets. First, offsetting GHG emissions does not generate a climate benefit unless the GHG reductions and removals generated through VCM activities are measured more conservatively than the original emissions. In the absence of strong VCM protocols and controls, the risk is that the opposite is the case and that offsets are not fully compensating for GHGs emitted.

Second, if companies can offset emissions for a cheaper price than it would cost them to reduce or remove GHG emissions in their own operations and supply chains, then companies may be disincentivized from taking climate action. In the same way, if carbon credits allow individuals to ease their guilt of doing carbon-intensive activities – such as flying – individuals may not change their behaviors.

Third, using VCM credits as offsets may come with a risk of double claiming. While opinions vary on whether VCM credits are at risk of being double claimed, some see a risk of greenwashing associated with corporates claiming carbon credits that governments may have achieved anyways in the context of their NDCs. Corresponding adjustments have been proposed as one way of addressing double claiming in the context of VCM credits and their relation to NDCs. There are also non-offset uses of carbon credits that can help to mitigate this risk, which are discussed below.

Are there any non-offset uses of carbon credits?

Private actors, such as corporations, non-governmental organizations (NGOs), and foundations can avoid the pitfalls of offsetting and accelerate climate change mitigation if they do not use carbon credits as offsets.

Instead of buying carbon credits to offset emissions, companies can buy carbon credits to contribute to broader climate finance, climate action goals, or corporate social responsibility goals. Non-offsetting carbon credits are acquired and canceled without being applied against carbon pledges or for the marketing of carbon neutral products.

Non-offset uses for VCM credits move away from the idea that some environmental harms could be permitted as long as they are offset by environmental goods. Instead, non-offset uses promote the achievement of environmental benefits. In addition, carbon credits that are not used as offsets can contribute directly to the achievement or overachievement of host countries’ climate commitments without any risk of double claiming. In this way, non-offset uses for carbon credits represent a paradigm shift in which the VCM delivers finance for climate change mitigation and sustainable development benefits in a way that truly reduces global emissions.

Further Reading

- Broekhoff, D., Gillenwater, M., Colbert-Sangree, T., & Cage, P. (2019). Securing Climate Benefit: A Guide to Using Carbon Offsets (p. 59). Retrieved from Offsetguide.org/pdf-download/

- Climate Focus. (2021). VCM Related Claims Categorization, Utilization, & Transparency Criteria. Retrieved December 1, 2021, from https://vcmintegrity.org/wp-content/uploads/2021/07/Criteria-for-Voluntary-Carbon-Markets-Related-Claims.pdf

- Trouwloon, D., Streck, C., Chagas, T., & Martinus, G. (2023). Understanding the Use of Carbon Credits by Companies: A Review of the Defining Elements of Corporate Climate Claims. Global Challenges, 7(4), 2200158. https://onlinelibrary.wiley.com/doi/abs/10.1002/gch2.202200158

- Watson, E., Chang, A., Carrillo Pineda, A., Anderson, C., Cummis, C., & Stevenson, M. (2023). SBTi Corporate Net-Zero Standard Version 1.1. Retrieved from https://sciencebasedtargets.org/resources/files/Net-Zero-Standard.pdf

Acknowledgments

Authors: Melaina Dyck, Charlotte Streck, and Danick Trouwloon

Designer: Sara Cottle

Contributors: Leo Mongendre, María José Rodezno, Laura Carolina Sepúlveda, and Theda Vetter

Date of publication: October 2023

The Voluntary Carbon Market Explained (VCM Primer) is supported by the Climate and Land Use Alliance (CLUA). The authors thank the reviewers and partners that generously contributed knowledge and expertise to this Primer.